For all my real estate investors out there, the Gross Rental Income or (GRI) of a rental property is critical information in calculating your Return on Investment (ROI). This is where your real estate agent is very much needed because a property being marketed for sale does not necessarily advertise its GRI to the public on Zillow, Realtor.com, Redfin etc.

First, the definition of gross rental income: It is the entire amount of the income generated by renting the property either on a short term basis or a long term basis. “Gross” meaning this is the amount calculated before management fees and splits are deducted and ROI or cash flow can be calculated.

How to get this information from a particular property listing? Contact me, your Myrtle Beach Area Realtor and I can provide the inquiry needed to either the listing agent, seller or management company depending on who is gatekeeping this information on a property that is listed for sale in the Coastal Carolinas Multiple Listing Service.

What kind of information can I expect from a GRI report? A GRI report will give you valuable information on when a property was rented and for how much, especially on Short Term Rentals. Long term rentals will obviously be a 12 month consistent report on income and short term rentals will vary on season. The other information you can gather from this report is what the management split is and what fees to expect, like credit card swipe fees that may be passed on to you.

Additional information you can gather from a rental unit’s GRI report is the Vacancy Rate. What percentage of the time in a 12 month period was your unit rented? A unit for sale that has been on the rental market should provide this information that can be very valuable to the real estate investor. Investors can make decisions on management, marketing and rates based on performance of the unit being rented throughout the year.

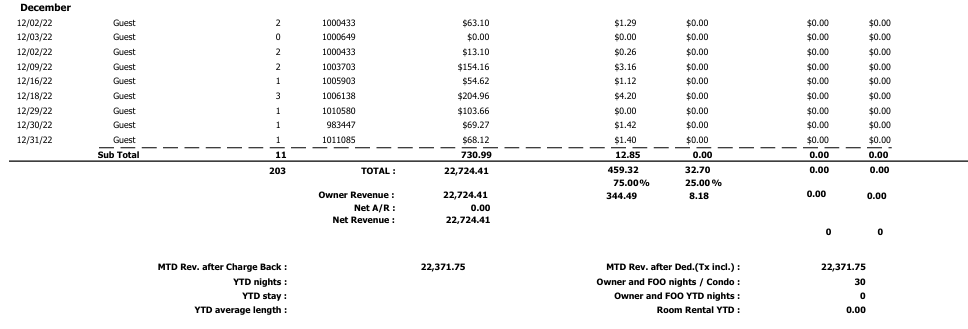

Let’s take a look at what your Gross Rental Report will look like:

In this sample GRI report, you can see that the condo unit was rented for 7 nights in January, the room revenue, the credit card fees associated with the rental. At the bottom of each month is a summary of gross rental income. This not indicative of what your unit will rent for, we should look at that individually. Contact me and we will dig deeper!

The summary at the bottom will tell you what the unit earned for the year in NET and that is after the management fees. As you can see here, this particular unit earned almost $23,000 in 12 months net. You can also see in the management split is 75% to the owner and 25% to the management company.

There are other cost considerations when investing in a condo, rental property or investment property for short term rental in Myrtle Beach. I’d be happy to discuss your considerations with you if you are considering investing in property in Myrtle Beach!

It’s a great day at the beach!

Dawn

Leave a comment