I’ve seen many faces fall when buyers discover the oceanfront condo purchase in Myrtle Beach is going to be a challenge. Condotels, are basically short term condo living in an hotel like atmosphere. These are simplified terms, but they are terms the bank knows well.

What makes a condominium a condotel and not just a condominium. In a few simple words, the rentals of these units. If there is a front desk, where visitors or owners check in at a front desk, more than likely you are in a condotel. It does get more complicated than that, and depends on how many owners reside in the building vs. renting in the building. These definitions are generalized so let’s get to the determiner of these condotels, the banks.

Big banks consider financing on these condo units “non-warrantable” mortgage loans. They can’t sell it to the big mortgage buyers like Fannie Mae or Freddie Mac. In general, the down payment will be a bit higher and the rate will be a little higher than a conventional mortgage. The big banks can’t sell this loan, like they like to do.

If you have a dream of buying an oceanfront condo or short term rental for AirBnB or VRBO and financing it, do not fret. There are plenty of lenders and lender programs to work out the details and terms you can live with. Just like buying a car, you’re either paying cash or your shopping the best financing deal. The same holds true when you buy a short term rental condo in Myrtle Beach.

To make an offer on these condotels properties for purchase, the first step is to speak to a qualified lender and obtain a pre-approval. You will understand the terms and the cost by doing so first. There is nothing more burdensome than not doing this and not having your offer considered because the pre approval does not meet standards.

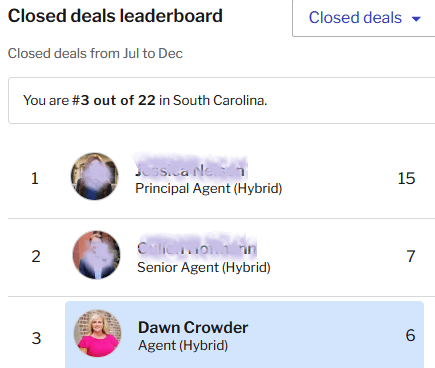

Reach out to me, I can connect you to lenders and I can get you in the units you’re interested in touring. A condo unit purchase in Myrtle Beach is still a great value for being oceanfront and the price.

Leave a comment